Financial Overview

Advancing Columbia’s academic mission depends on strategic and financial planning that provides sufficient resources for both current and future needs, ensuring that the University can support today’s students and scholars as well as those of future generations. Our planning must adapt both to new opportunities to advance Columbia’s mission as well as to unforeseen challenges such as those posed by the COVID-19 pandemic.

This page offers an overview of University resources, provides answers to a range of questions about topics including the endowment, and links to resources including University financial reports.

What's in the Financial Statements

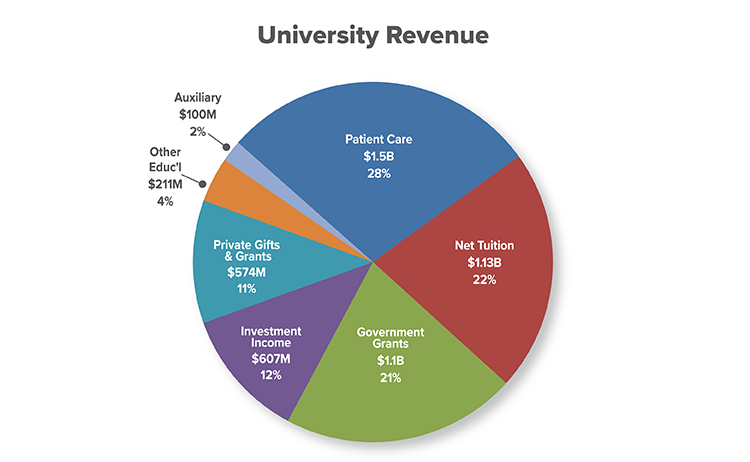

Columbia’s operating revenue for the last fiscal year (2021) was $5.2 billion.

The University’s mission is reflected in its three largest revenue streams: patient care revenue (clinical care delivered in our doctors’ offices as well as services provided at affiliated inpatient facilities), net tuition (all tuition payments minus financial aid provided to students), and government grants and contracts (typically supporting our research activities).

Our revenue picture also conveys the critical support we receive from philanthropy through private gifts and the annual distribution from our endowment. This support enables the University to maintain a balanced budget, sustain its physical campus, and invest in the future.

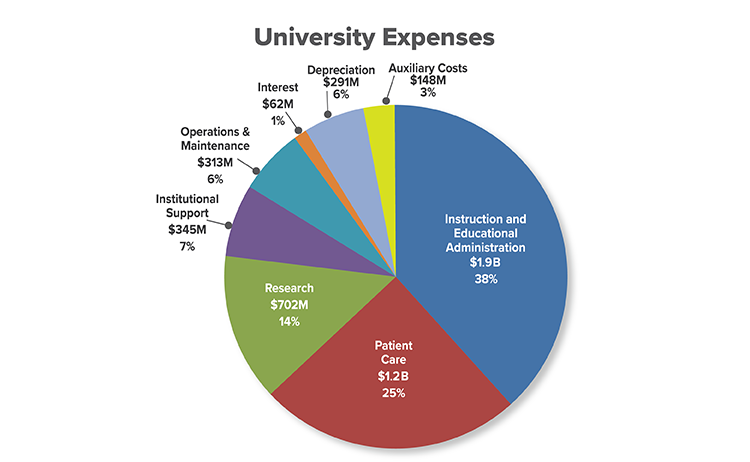

Total operating expenses for fiscal year 2021 were $5.04 billion.

The largest category of expenditures is instruction and educational administration—the costs of delivering the courses and programs that comprise Columbia’s educational enterprise, as well as services provided to students such as career advising. Additional expenditures flow from our key activities such as patient care and research, as well as the costs to support infrastructure for the entire enterprise.

Expenditures for salaries, wages, and benefits are included and cut across the categories of functional expense reported on our financial statements. These salary and benefits expenses are roughly two thirds of total University expenses.

Like most of its peers, Columbia has units that may generate an operating surplus in a given year. This operating surplus aggregates to a total surplus, referred to in our financial statements as the “change in net assets from operating activities.”

Our auxiliary operations and residential real estate are just two examples of units with surpluses. They generate an operating surplus in order to reinvest those funds into capital projects for renovations and upkeep.

Another source of operating surplus can occur when Columbia receives gift funding in one period for activities that will stretch over multiple fiscal years. This creates a build-up of funds in one period and the spending down of funds in the subsequent year. Because our operating revenue reflects the commitments for gifts (pledges, as well as outright cash gifts), there can at times be substantial fluctuations in operating surplus due to the timing of the actual expenditures of the gifts.

Given the decentralized financial model at Columbia, a substantial portion of the operating surplus is restricted to school- or department-specific uses. Some portion of the operating surplus is held by the central administration. Much of the centrally held surplus provides funding for capital construction projects to maintain and improve our campuses.

University Endowment

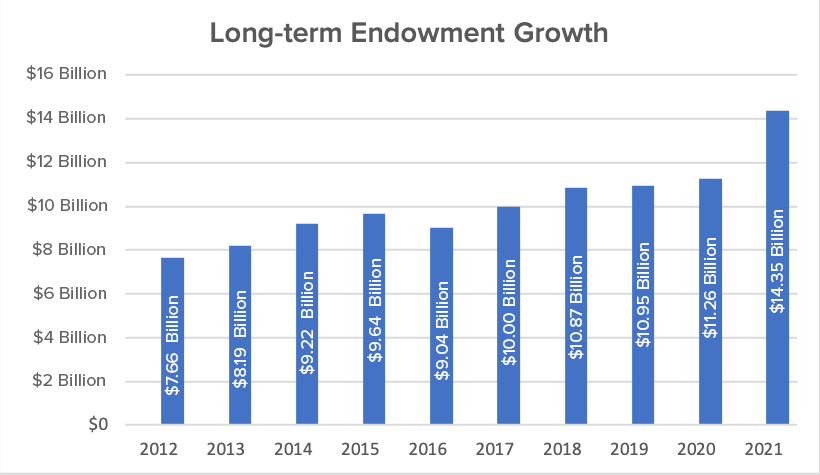

Endowment funds are an important part of Columbia operations, and they play an integral role in helping the University achieve its goals. They provide Columbia with a permanent source of funding to support financial aid, faculty and research, schools, departments, institutes, centers, capital projects, and more. Roughly 12% of the University budget is currently supported through an annual distribution from the endowment.

The Columbia Investment Management Company (IMC) is charged with managing the bulk of University endowments. It is a wholly owned subsidiary of Columbia University. The IMC is staffed by a team of investment professionals and advised by a board of Columbia Trustees and former Trustees, as well as a small number of non-Trustee investment experts.

Endowment funds are managed by Columbia’s investment team through one commingled pool but are tracked separately, not unlike units in a mutual fund. The scale of the pooled assets allows the University to take advantage of a range of investment vehicles to provide a higher total return over time within an acceptable level of risk. The annual distribution, or payout, policy is set by Columbia’s Board of Trustees.

Columbia’s endowment closed at $14.35 billion for the period ending on June 30, 2021. The University’s trailing 10-year annualized net investment return was 9.9 percent (after outside manager fees).

We are often asked why Columbia can’t use some of its endowment principal to pay for urgent needs. First, the gifts that comprise a university’s endowment are typically restricted for specific purposes: to establish a scholarship, to provide faculty support in a particular field, to construct new facilities, or to support research on a designated topic. They cannot be repurposed for other uses, however urgent, that contravene the donor’s intent.

Second, endowments represent a promise by the University to sustain those commitments over time. It may be tempting to draw down the endowment to provide more funds for today’s needs. But Columbia could not provide the level of excellence that it does now if past leaders had failed to sustain the purchasing power of their endowments. Columbia similarly has an obligation to future students and faculty to continue to grow the endowment to maintain the caliber of the institution.

Approximately 12% of Columbia’s annual budget is funded with endowment distributions. The size of these distributions is governed by the Endowment Spending Rule. An aggressive spending policy that outpaces real returns over the long-term would erode the ability of the endowment to fund essential teaching, research, and student support in the future.

The spending rule is a formula used to determine the annual endowment distribution, or payout. As already noted, it is designed to be responsive to investment returns and inflation, enabling the endowment to protect the corpus (original gift) and retain its purchasing power. Any growth in excess of the annual distributions is retained in the endowment to buffer losses and enable growth over the long term.

The current endowment spending rule applies a target spending rate of 4.5-5.0 percent to a trailing market value of the endowment. It also factors in the prior year’s spending grown by inflation. Given the mechanics of the spending rule, the gains or losses in endowment return in any given year are generally phased in over time.

In the 2021 fiscal year, the distributions from the endowment for ongoing operations, excluding internal management fees, were effectively 5.3% of the endowment’s market value at the beginning of July 2020, which is the start of Fiscal Year 2021.

Certain funds have reinvestment provisions, bringing our effective spending rate to 5.0% of the endowment’s market value at the start of Fiscal Year 2021. A detailed explanation of the University spending policy is provided in the notes to our financial statements.

The Advisory Committee on Socially Responsible Investing was established in 2000 to advise University Trustees on ethical and social issues that arise in the management of the investments in the University endowment.

The committee’s twelve voting members are drawn in equal proportion from students, faculty, and alumni to ensure that it is broadly representative of the University community. The process for the appointment of its members provides for balanced representation, over time, of the University's divisions and schools. Two University officers sit as non-voting members in addition to the twelve voting members.

Any member of the Columbia community can submit a proposal to ACSRI. The Committee’s proposal submission guidelines describe the process for bringing forward proposals, as well as the criteria used to evaluate proposals. The ACSRI may decide to evaluate a proposal and then may make a recommendation to the Board of Trustees regarding specific action. The ACSRI is advisory by definition, and any investment policy decisions require the approval of the Board.

The Columbia Investment Management Company (IMC) operates within an investment policy framework to maximize return utilizing an acceptable level of risk for the University, as approved by the board. However, there are instances in which the Trustees have set specific investment guidelines to ensure consistency with the values of the institution.

Specific resolutions guiding the University’s investment (or non-investment) in fossil fuels, tobacco, private prisons, and Sudan can be found on the Columbia Finance website.

Annual Financial Reports

Each fiscal year, the Trustees of Columbia University release the consolidated financial statements of the institution, which includes the opinion of independent auditors.

University Statements and News

October 21, 2021

We have posted our audited financial statements for the fiscal year that ended June 30, 2021.

October 21, 2021

The total value of the Columbia endowment as of June 30, 2021 was $14.35 billion.

September 20, 2021

As Climate Week NYC begins, the university explores creating a fully electrified campus.

April 08, 2021

A new effort dedicated to raising $1.4 billion in financial assistance for students by June 2025.